does texas have inheritance tax 2021

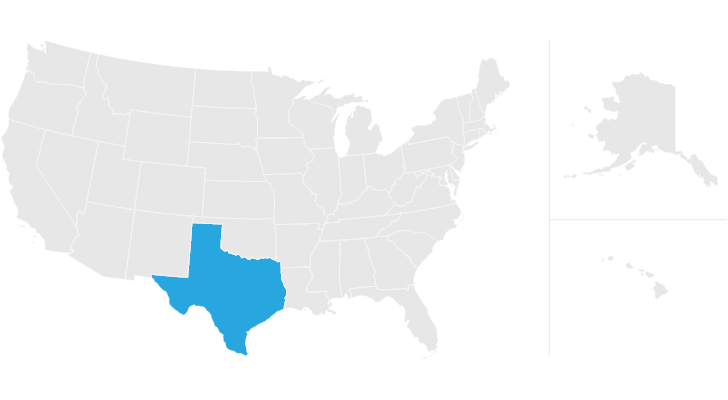

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. The top estate tax rate is 16.

Texas Estate Tax Everything You Need To Know Smartasset

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

. Texas does not have an inheritance tax. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Inheritances can be subject to complex tax rules although theyre usually not taxed as income.

As of 2019 only twelve states collect an inheritance tax. There is a 40 percent federal tax however on estates over. However this is only levied against estates worth more than 117 million.

Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. Elimination of estate taxes and returns. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Inheritance Tax In Texas. Fortunately Texas Is One Of The 33 States That Does Not Have An. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There is a 40 percent. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. Select Popular Legal Forms Packages of Any Category.

For 2020 and 2021 the top estate-tax rate is 40. Inheritance taxes in Texas. Or have Inheritance and Estate Tax forms mailed to you contact the Inheritance and Estate Tax.

There is no inheritance tax in Texas. There is a 40 percent federal tax. Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal estate tax limits the amount you can leave to your heirs.

All Major Categories Covered. If your great-aunt Kelly leaves you 500000 you dont have to report it on your tax. The federal gift and estate tax is a tax that is imposed by the federal government on all qualifying gifts made by a taxpayer during hisher lifetime and all.

There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned. The Federal Gift and Estate Tax. For 2021 the IRS estate tax exemption is 117.

Gift Taxes In Texas. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. The state of Texas does not have any inheritance of estate taxes.

This is because the amount is. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. However if a loved one who lives in another state leaves you money you may be subject to inheritance taxes in.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. Twelve states and washington dc.

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Planning Around 2022 Tax Exemptions Houston Estate Planning And Elder Law Attorney Blog November 23 2021

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Determining If Estate Taxes Apply To A Texas Property Houston Estate Planning And Elder Law Attorney Blog August 24 2021

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Does Property Passed By Transfer Receive A Step Up In Basis

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Estate Tax Exemption For 2023 Kiplinger

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Changing Inheritance Taxes Would Be Devastating For Farmers Texas Farm Bureau

Transfer On Death Tax Implications Findlaw

Californians Could Ruin Texas But Not The Way You Might Think Texas Monthly

/https://static.texastribune.org/media/files/d1e98fb8f28a8457df679192b4fa976b/2022Elections-glossary-leadart-v1.png)

Texas Governor Lieutenant Governor And More What Do These Offices Do The Texas Tribune